ASSET TRACKER FOR EXEL 3.12.2141

Easy to use Asset Register which can be used within any country with S/L depreciation rules. Calculates straight line monthly depreciation and book values by item and by asset category (office supplies, computers, equipment..etc). Summary report

Last update

5 Jul. 2007

Licence

Free to try |

$99.95

OS Support

Windows

Downloads

Total: 397 | Last week: 0

Ranking

#1216 in

Accounting & Billing Software

Publisher

Excelerator Products Inc

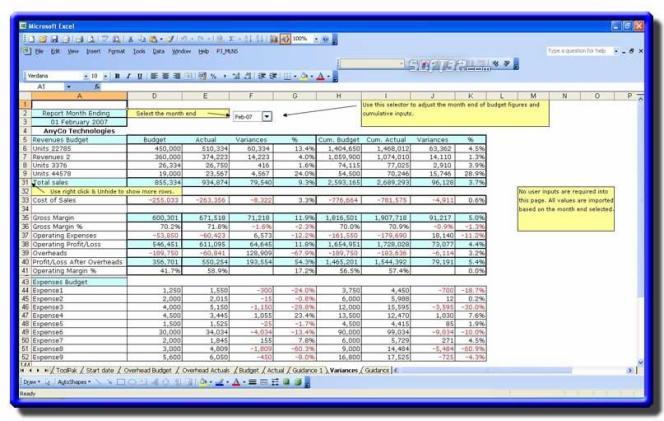

Screenshots of ASSET TRACKER FOR EXEL

ASSET TRACKER FOR EXEL Publisher's Description

Asset Register PRO for Excel supplies nine asset registers plus YTD depreciation reports for fixed, intangible and investment assets, updating and reporting depreciation calculations and book values at each month end. Each asset entered into the register can contain the asset sequence number, date of purchase, description of asset, serial number, supplier's name, purchase order number, G/L reference code, accounting cost, useful life (depreciation period), physical location, plus if/when disposed/sold and gain/loss calculations and impairment ledgers for investments, intangibles and goodwill. Asset Register PRO can be used by the smallest to the largest enterprise to keep track of their assets and monthly depreciation calculations. Asset Register PRO applies the straight-line depreciation method, and the declining balance method adjusted annually and monthly. Depreciation tables supply monthly depreciation and cumulative depreciation from the acquired date to any period up to 240 months.

Quick and easy entry of assets into the registers using Excel's Data (Entry) > Form with the Name box.

Asset Register PRO provides continuous month end sequencing so that the asset class registers update each asset depreciation and book value every month automatically and combines all month end values into a Year To Date and Totals report. Different depreciation periods can be applied to individual assets and within each class of assets.

Asset Register PRO calculates book values at disposal dates and gain/losses on disposal.

All month end depreciation calculations and book balances can be recalculated backwards and forwards to any month end date by making a simple one step adjustment to the month end date held in the adate field. You can recalculate and forecast depreciation totals and written down balances for any month end past or future. Such calculations can be very useful for preparing financial business forecasts and for checking depreciation calculations.

Quick and easy entry of assets into the registers using Excel's Data (Entry) > Form with the Name box.

Asset Register PRO provides continuous month end sequencing so that the asset class registers update each asset depreciation and book value every month automatically and combines all month end values into a Year To Date and Totals report. Different depreciation periods can be applied to individual assets and within each class of assets.

Asset Register PRO calculates book values at disposal dates and gain/losses on disposal.

All month end depreciation calculations and book balances can be recalculated backwards and forwards to any month end date by making a simple one step adjustment to the month end date held in the adate field. You can recalculate and forecast depreciation totals and written down balances for any month end past or future. Such calculations can be very useful for preparing financial business forecasts and for checking depreciation calculations.

Look for Similar Items by Category

Feedback

- If you need help or have a question, contact us

- Would you like to update this product info?

- Is there any feedback you would like to provide? Click here

Popular Downloads

-

KaraFun Karaoke Player

2.6.2.0

KaraFun Karaoke Player

2.6.2.0

-

Kundli

4.5

Kundli

4.5

-

Macromedia Flash 8

8.0

Macromedia Flash 8

8.0

- FastSum 1.9

-

FastSum Standard Edition

1.6

FastSum Standard Edition

1.6

-

Cool Edit Pro

2.1.3097.0

Cool Edit Pro

2.1.3097.0

-

Cheat Engine

6.8.1

Cheat Engine

6.8.1

-

My Talking Tom

1.0

My Talking Tom

1.0

-

Hill Climb Racing

1.0

Hill Climb Racing

1.0

-

Tom VPN

2.2.8

Tom VPN

2.2.8

-

C-Free

5.0

C-Free

5.0

-

Windows XP Service Pack 3

Build...

Windows XP Service Pack 3

Build...

-

Vidnoz AI

1.0.0

Vidnoz AI

1.0.0

-

Netcut

2.1.4

Netcut

2.1.4

-

Facebook Messenger

440.9.118.0

Facebook Messenger

440.9.118.0

-

Vector on PC

1.0

Vector on PC

1.0

-

FormatFactory

4.3

FormatFactory

4.3

-

Auto-Tune Evo VST

6.0.9.2

Auto-Tune Evo VST

6.0.9.2

-

Grand Theft Auto: Vice City

1.0

Grand Theft Auto: Vice City

1.0

-

Minecraft

1.10.2

Minecraft

1.10.2